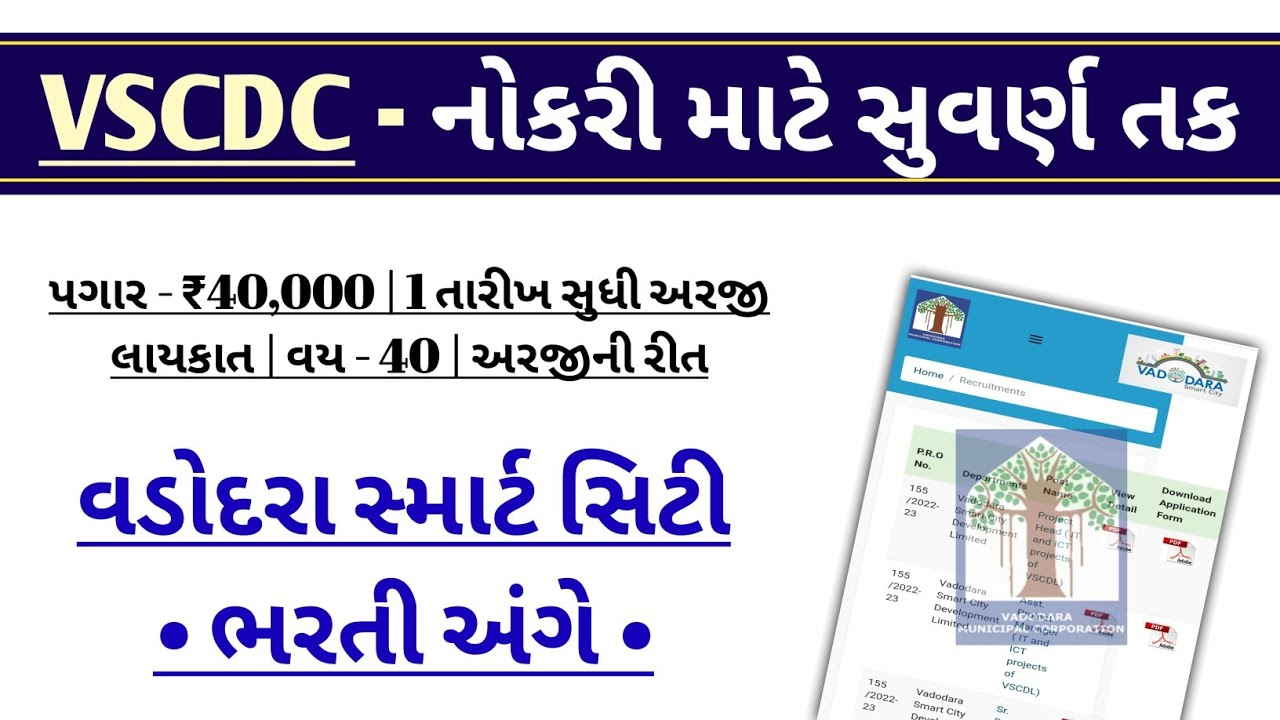

Vadodara Smart City Development Limited (VSCDL Recruitment 2024) has published an Advertisement for the MS Office Expert Posts. Eligible Candidates are advised to refer to the official advertisement and apply for this post. You can find other details like age limit, educational qualification, selection process, application fee, and how to apply are given below. Keep checking www.jkupdates.co.in/ regularly to get the latest updates

VSCDL Recruitment 2024 : Overview

- Organization Name : Vadodara Smart City Development Limited (VSCDL )

- Posts Name : MS Office Expert

- Vacancies : 01

- Job Location : India

- Last Date to Apply : 10-11-2024

- Mode of Apply : Offline

- Category : VSCDL Recruitment 2024

Education Qualification

- Any graduate from reputed institute.

- Should have certificate course of MS Office from any reputed institute.

- Must be aware of various design/template in power point.

- Command over English language is must.

Experience

Salary

- Rs. 25,000/-Fixed Per Month. Salary increment would be 10% annually based on performance

Age Limit

- 35 Years

Selection Process

- Candidates will be selected based on an interview.

How to Apply

- Eligible candidates may send their application & necessary documents to the given address in the advertisement

Important Links

- Notification : Click Here

- Official Website : Click Here

Important Dates

- Apply Last Date : 18/11/2024

As individuals age, health insurance becomes an essential part of securing peace of mind and ensuring quality care in the later stages of life. Health insurance for seniors is specifically designed to address the unique healthcare needs associated with aging, covering critical aspects such as chronic condition management, preventive care, and hospital stays. Seniors often face rising healthcare costs, and selecting the right health insurance plan can dramatically reduce out-of-pocket expenses while providing access to a wide network of doctors and specialists. From Medicare supplements to private health plans, seniors have a range of options tailored to fit varying healthcare needs and budgets. However, with so many options available, understanding which health insurance policy is the best fit can be overwhelming. Working with knowledgeable advisors or using comparison tools can help seniors choose a plan that covers essential health needs while keeping costs manageable.

As we age, managing health expenses becomes a priority, and having the right health insurance for seniors is a vital part of staying prepared for any medical needs. Seniors often face increased risks of chronic illnesses, and routine check-ups become essential, making comprehensive health coverage crucial. Health insurance options for seniors, including Medicare Advantage plans, Medigap, and private health insurance, offer various levels of coverage for doctor visits, prescription medications, hospital stays, and sometimes even specialized care, like nursing or home health services.

Medicare Advantage plans, for instance, provide coverage beyond Original Medicare, often including vision, dental, and hearing services, which can be highly valuable for seniors. Medigap, on the other hand, helps fill gaps in Medicare, covering copayments, deductibles, and coinsurance, which can quickly add up in older age. For seniors looking for flexibility and a broader network of healthcare providers, private health insurance plans can offer customizable options.

Choosing the right plan can feel overwhelming, but tools and resources such as online comparison platforms, licensed insurance agents, and senior-focused organizations can simplify the decision process. Factors such as premiums, deductibles, co-pays, and maximum out-of-pocket costs should be carefully considered to ensure affordability and coverage that aligns with specific health needs. Ultimately, investing in health insurance for seniors not only brings peace of mind but can also make a meaningful difference in the quality and accessibility of healthcare as one ages.

Navigating health insurance options for seniors can be complex, but it’s one of the most valuable investments for ensuring healthcare security in retirement. As life expectancy increases, more seniors are prioritizing health insurance plans that cover both routine care and potential medical emergencies. Medicare is the foundation for many, but it has coverage gaps that can lead to significant out-of-pocket expenses. That’s where supplementary options, such as Medicare Advantage (Part C), Medigap (Supplemental Insurance), and prescription drug coverage (Part D), come into play. Each of these options can enhance traditional Medicare coverage, giving seniors access to a broader range of services and reducing personal healthcare costs.

Medicare Advantage plans are popular because they often provide added benefits not included in Original Medicare, such as dental, vision, and wellness programs. For seniors who want even more security, Medigap plans are an effective solution to cover expenses like deductibles and coinsurance. This additional layer of coverage is crucial for managing costs associated with frequent doctor visits or unexpected hospitalizations, which can otherwise strain a fixed income. Prescription drug costs, too, can be burdensome, but with Part D coverage, seniors can better manage expenses associated with long-term medication needs, which are common in later years.

For those who may not qualify for Medicare or who seek broader coverage options, private health insurance plans offer flexibility, allowing seniors to customize their plans to include coverage for specialized services or select healthcare providers. Many private insurers also offer plans specifically designed for senior healthcare needs, focusing on conditions such as arthritis, diabetes, and cardiovascular health.

When choosing a health insurance plan, it’s important for seniors to assess their unique health needs and budget constraints. Working with a licensed insurance broker or using online comparison tools can help identify the best plan, whether that’s through Medicare supplements or private insurance. Furthermore, understanding the nuances between HMO and PPO plans can help seniors select a plan that provides the right balance between network flexibility and cost savings. With the right health insurance, seniors can access preventive care, receive timely treatment, and enjoy a higher quality of life without the constant worry of unexpected medical bills.